June Newsletter

Welcome to our June Newsletter

Winter has certainly arrived, with some very fresh cool mornings and evenings.

We ask that you please supply your child with warm spare clothes as we seem never to have enough! Alway name them too please!

Last Friday's pyjama day was so much fun with all our little people staying warm and cosy during the day. As you can see our Early Learners enjoyed a slumber party.

Our centre events coming up in July are as follows:

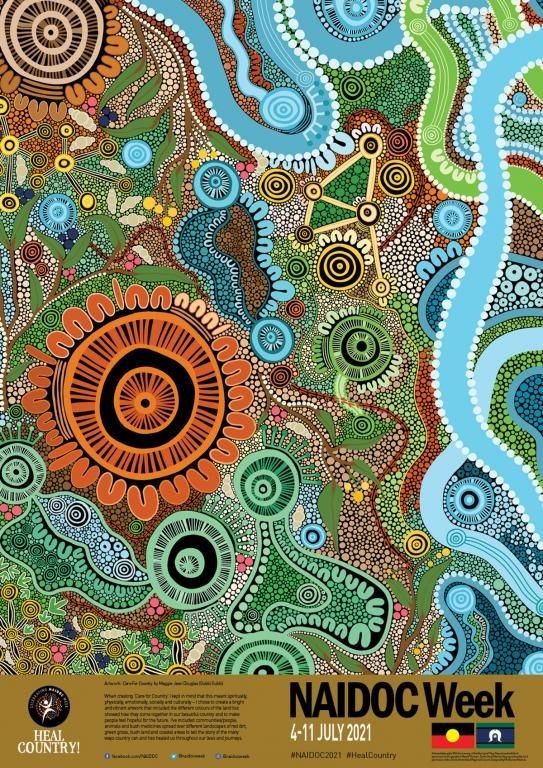

- 4th- 11Th July NAIDOC week activities

- 26th July Crazy Hair day

- 28th July Dental visit

Important Information from CCS

30 June CCS balancing deadlines approach

Two important deadlines fall at the end of this month for families, for the balancing of Child Care Subsidy (CCS). If families do not confirm incomes for 2018 - 2019 & 2019 - 2020 income years, you could risk loosing your CCS.

Who needs to confirm their family income

If you got Child Care Subsidy (CCS) for the 2018–19 or 2019–20 financial year, you must confirm your income. Most parents have already done this. If you haven't, do it now.

When you need to confirm income for 2018–19

If you got CCS for 2018–19, we asked you to confirm your income by 31 March 2021. If you still haven't confirmed your family income by 30 June 2021, you may need to pay back all the CCS you got for 2018–19. Your CCS will also cancel from 12 July 2021. You will need to make a new claim if you wish to get a reduced fee again.

When you need to confirm income for 2019–20

If you got CCS for 2019–20, you need to confirm your family income by 30 June 2021. If you don't, your CCS will reduce to 0%. This means you'll need to pay full fees when you access child care. If you confirm your income after 30 June 2020, we can start your CCS again. But if there's a gap between your CCS stopping and you confirming your income, you'll miss out on CCS for that time.

How you confirm your income

- lodge your tax return with the Australian Taxation Office (ATO)

- tell Centrelink you don't need to lodge a tax return and confirm your income online

If you have a partner, they'll need to do this too. If you separated during the year, you will need your ex-partner's income. If you've lodged your tax return, the ATO will send Centrelink your income information. They usually get this within 28 days from when you get your Notice of Assessment.

If you or your partner don't need to lodge a tax return, you need to let Centrelink know. You must do this, even if you've told the ATO that you don't need to lodge. You can do this and confirm your income for the year using either your:

- Centrelink online account through myGov

- Express Plus Centrelink mobile app.

Please click the following link for more information Balancing Child Care Subsidy - Department of Education, Skills and Employment, Australian Government (dese.gov.au)